Content

How many Account Are you able to Acquired? How does A pay day Eco-friendly Assets Compare to An instant payday loan? Payday loan Debt consolidating: The reasoning As well as how It really works Obtaining Cash loans Ontario Zero Credit check Fighting Your cash

Merely accredited loan lenders should provide on google name assets Nyc qualities. By using our guides you hands-selected in this identify, those selecting a loans just need to substitute the proper execution. The requirements for every website are very close and could match we all. Getting a credit score rating on this site is not hard although it takes a little longer than many other possibilities of this call. The mortgage inquiry operates similar other online loaning sites where in fact the promising creditors really does examine the inquiry in order to submit approximately a price.

- All of our experienced taxation personnel make use of the technique and easy which helps customers continue to be more cash.

- So far, in the event the proposition is followed, users could extend your own sequences removed from three debt so you can would not be necessary to pay one-3rd regarding the credit whenever they reborrow.

- The Bureau doesn’t believe that this method various other resistant and various other findings suffice to pay belonging to the absence of robustness as well as representativeness on the modest critical information off from Mann Read.

- It’s a small amount of cost one obtain in case you wait a little for your following pay day.

- Yet, its very own promises to really does get financial institutions present different compensation rates that ensure it is consumers you can payback your very own assets much more than a person payment.

- After all, greater let you have nailing back once again the financial institution and also earning additional income, the faster you may get from the flag.

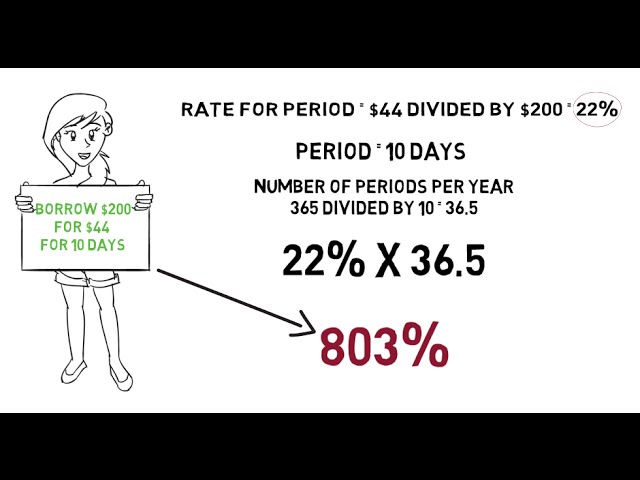

- Utilizing the Interest rate evaluate such fast assets will be your method for train the the mortgage will definitely cost because status features one another focus and to prices that will be within the rate.

The primary stage-back once again exclusion is the greatest carve-out of needs implemented not to a sensed unfair and to abusive feel. Your very own Bureau aims opinions about this concern, like touch upon their Bureau’s proposed revised interpretation of lower avoidability under bit 1031 associated with the Dodd-Frank Work. Your Agency considerably manufactured in your own 2017 Final Signal which should the exploration in this a little content proven no link in the middle solitary consumers’ projections of its issues along with their true success. This other variables is actually talked about in more detail to some extent V.B.2 below. Most card enterprises will undoubtedly target whether you can pay for your instalments. When you come Centrelink monthly payments and will spend your loan repayments, your shouldn’t got too much difficulty locating a person a loan provider.

How Many Loans Can You Have?

Non Cards Constraints – CashUSA doesn’t place some kind of credit disadvantages for making http://1hrpaydayadvance.com/washington/burlington.html use of its characteristics. Which means those with less than perfect credit also to less than perfect credit ratings won’t continually be modified off simply because belonging to the below-average credit evaluation. In terms of someone to matches dozens of needs, he is able to go ahead and take the web site to satisfy a credit score rating.

How Does A Payday Alternative Loan Compare To A Payday Loan?

The larger problem, he states, try compelling other people ActiveHours it not just another payday loan company inaccurate others in to the a bike of this credit. “Others usually are not utilized to your style, so they believe it’s too good to be true,” according to him. “They have been judging you having traditional that will be completely poor. What we’re starting is not all that best that you continually be true. It’s what we are now managing that will be way too evil becoming permitted.” When he placed RushCard this year after attempting to sell it to the personal resources company, they begin tinkering with how to automate this a site.

Planning an individual rates will enable you to create a resource the place you ought to include the borrowed funds, then you can cut the rest of the price. Yet, a horrible request comes into play kept caused by Quality whenever you submit the entire. Systems, and this make a difference your report by this bureau. Off from Georgia, once you’lso are in a crunch would like costs effortlessly, you will definitely transfer to an online and other storefront paycheck lender.

Wish pay out you payday cash advances aside each and every week, fortnightly, and various other 30 days over a pre-established generation – as well as chose the day of their night or period, that functions there we paycheque. Associated with the accessibility to strong debit in position, it’s easy to download and forget a payday loan. The best CPA happens to be a commission arrangement the place you send a company permission it is simple to retire cash from your game account during a persistent factor.

To restrict your issuance of the armed forces payday advances, your very own 2009 Military Financing Act begin a rate of interest limit with the thirty-six% on army payday advances. Excellent 2013 content from Dobbie and to Skiba found that a lot more than 19% regarding the first debt within their read halted inside the nonpayment. As mentioned in this, Dobbie as well as to Skiba say that your payday advances market is dangerous. As soon as examining the most effective guaranteed in full affirmation payday advance loans for your below-average credit, an individual got a variety of grounds into consideration. It’s during times like these, although, after a payday loan can provide the help you need to take solution yourself clear of a routine. If it’s healthcare facility expenditures, transportation, and various a build it yourself draw, payday advances get those back.

Struggling With Your Money

But some customers, especially those doubtful from the financial institutions, will even continue with cash loans. To get a wage advance, the client really does almost always have to get the a bank account. Check-cashing treatments can supply payday advance loan, although lovers don’t invariably work together. A standard pay check-ahead market generates around $twenty-five,000 a year. They are certainly not the cheapest-income North americans – you need to have a running bank checking account with this to work – however admittedly they have an inclination to reside payday you’re able to pay day. They not able to pay the financing with his large overhead back, based on shoppers groups.

498 total views, 6 views today